Monthly update - January 2026

Path for rates and property into 2026

The new year has started with a familiar theme: the economy is proving more resilient than expected. Jobs growth remains strong, inflation is still sitting above where the Reserve Bank of Australia (RBA) would like it, and financial markets are adjusting quickly. While strong employment is good news for households, it also makes the RBA’s job harder and keeps interest rates firmly in focus as we head into February. Here’s what’s happened, what markets are watching, and what it could mean for borrowers and property in 2026.

Jobs Growth Keeps Pressure on Rates

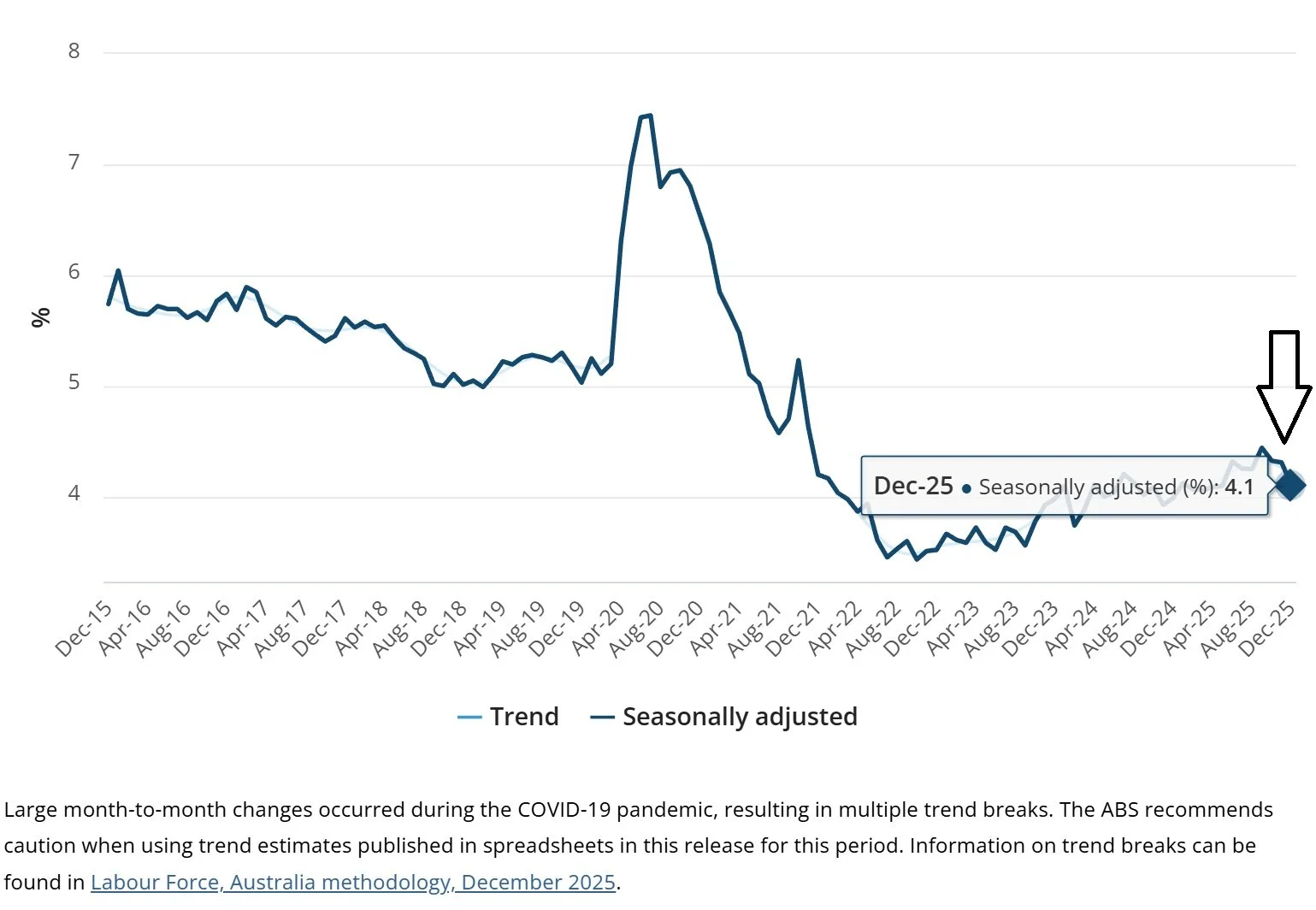

Australia added 65,200 jobs in December 2025, according to the Australian Bureau of Statistics. As a result, the unemployment rate fell to 4.1 per cent, stronger than the 4.3 per cent the RBA had forecast.

On the surface, this is positive news. More people are working, and the labour market remains tight. But from an inflation perspective, it’s not ideal. Strong employment can drive wages higher, which can keep inflation elevated for longer.

For the RBA, this data suggests the economy is running hotter than expected, reducing the case for near-term rate cuts and increasing the risk of another hike.

Bond Markets React — Fixed Rates Follow

Financial markets responded quickly to the jobs data. Both the 3-year and 10-year bond yields rose, reflecting expectations that interest rates may stay higher for longer. Bond markets are essentially pricing what they believe will happen to the cash rate in the future.

Off the back of this bond yield movement:

CBA increased its fixed rates this week

NAB has also lifted fixed rates, and has now done so twice in recent months

Take a look at the bond yield movement since October/November 2025. This is why we saw fixed rates increase recently.

What The Big Banks Are Forecasting

Now it's important not to get too carried away with what the money markets and economists suggest because they change their tune as soon as the data does. At the moment though, major bank economists, including HSBC, NAB, ANZ, CBA and Westpac, broadly agree that the labour market strength has increased the risk of a rate hike.

Much now depends on inflation. ANZ has noted that if quarter-on-quarter trimmed mean inflation exceeds 0.8 per cent, a rate hike becomes far more likely. As a result, next week’s inflation data, out on the 28th of January, will be pivotal for the RBA’s February meeting.

What This Means for Property in 2026

The RBA meeting on 3 February will take into account this quarterly inflation data, and if the prices of goods and services are still too high, then our variable interest rates will rise in response. This rate increase will likely take some heat out of the property market, which grew 8.6 per cent in 2025, according to Cotality.

Affordability is already stretched, and further constraints are coming.

From 1 February, APRA’s macro-prudential measures will limit high debt-to-income lending for investors. This should contribute to slower price growth through 2026

AMP’s Shane Oliver expects national price growth in 2026 to moderate to around 5–7 per cent, though outcomes will vary significantly by location and property type.

Buy Now or Wait?

We’re often asked whether it’s better to buy now or hold off, especially by first home buyers. What if the market doesn't increase as much as last year? What happens if the market dives a little?

On Thursday 29 January, we’re releasing our first podcast for 2026, breaking down what actually matters and how it's important to understand the market factors and historical data when deciding to buy.

Rates rise, they fall. Trying to “time it right” is difficult when expectations swing fast, and life (not the next RBA call) ends up driving decisions. Waiting for certainty can be costly, because demand keeps ticking along while supply stays tight and is likely to stay tight for a long time. Even in uncertain times, opportunities still exist, even when the headlines are negative.

If you’re thinking about buying this year, especially for the first time, it’s worth watching.

Our Top 10 Mortgage Tips for 2026

Each year, we publish our Top 10 Mortgage Tips, designed to help borrowers make clearer, more confident decisions.

The 2026 edition is now live, covering practical strategies for navigating rates, lending policy changes and borrowing capacity in the year ahead.

Final Thoughts

Strong jobs growth is good news for the economy, but it keeps inflation and interest rates, firmly in the spotlight. With key inflation data landing at the end of January and an RBA decision shortly after, the next few weeks will be important for borrowers and buyers alike. Clearer data should bring more certainty about the path ahead.

As always, the right strategy depends on your personal position and what is in your best interests. Like we said above, it's almost impossible to "time it right". More information however allows us to reduce the risk when it comes to our finance and property decisions.

If you’d like to talk through how this all can affect your plans for 2026, we’re here to help. For all our existing clients, we review loans every six months to keep things on track. If you’d like a fresh set of eyes on your loan now, just reply to this email, and John, Michael, or I, or one of our team members, will make sure you’re on the best terms possible.