Thinking of buying or investing? Read this first.

More buyers, low supply and stronger equity positions

Investor demand is up. First-home buyer activity is up. Australia’s largest housing bodies are warning that we need more supply, now. We need it fast to keep affordability from slipping even further. With changes to federal first-home buyer initiatives, strong population growth, and high construction costs, the market has momentum. Even if we see just one more rate cut, or none, prices are expected to keep rising into 2026. Households hold a lot of equity. We’re seeing experienced investors unlock this equity to prepare for opportunities, while first-home buyers are using the expanded Home Guarantee Scheme (HGS) to enter the market sooner. This behaviour is adding to demand, and lenders are starting to respond. We explore what’s driving the outlook and more, in this month’s Black and White Finance update.

Investor lending has surged

In the September quarter, investor loans rose 13.6 per cent, according to the Australian Bureau of Statistics (ABS).

The ABS noted that “falling borrowing costs and low vacancy rates are favourable conditions for investors.”

Investment loans now make up around 40 per cent of all new lending.

In short: Investors are back, and they’re a major force behind current demand.

Domain expects strong price growth in 2026

Domain forecasts that all major capitals will rise again next year:

Sydney: +7 per cent

Melbourne: +6 per cent

Brisbane, Perth & Canberra: ~+5 per cent

With investor participation rising, and the expanded federal schemes supporting first-home buyers, these forecasts are looking increasingly realistic.

Banks are also predicting a surge

The major banks are aligned:

Westpac, NAB, CBA and ANZ all expect nationwide dwelling prices to increase 4–9 per cent in 2026, depending on the city.

When banks and economists agree, it’s worth paying attention.

Banks pull back on company & trust lending

CBA has followed Macquarie in tightening its stance on company and trust structures for residential loans. We see these types of structures a lot with our more sophisticated investors.

From 22 November, CBA will only lend to companies or trusts with a personal guarantor if the borrower has held an existing CBA home or business loan for at least six months. Macquarie has stepped out of this space altogether, in the residential space.

This shift reflects the surge in sophisticated investment structuring, and banks are acting to manage risk – to slow down the growth.

Momentum remains strong, even with APRA pressure

The Australian Prudential Regulation Authority (APRA) has raised concerns about the pace of the housing market, and perhaps the banks like CBA and Macquarie are being proactive here before they are scrutinised by the regulator – a proactive measure. If they run the risk of coming under the microscope for being an enabler of financial stress if lending standards slip, it would be a reputational disaster. Banks adjust policy settings all the time, to slow down certain lending, or speed it up.

But even if:

investor lending is moderated,

affordability remains challenged, and

rate cuts slow or pause…

…property prices are still expected to grow through 2026.

That’s because the core drivers aren’t changing: strong demand, limited supply, and households with higher-than-expected equity.

Australia needs more homes, urgently

The Housing Industry Association says Australia needs 1.9 million additional homes for the average single-income earner to afford a home again. This is an enormous number. The federal goal of building 1.2 million new homes in five years is falling short. In the first year alone, completions missed the target by 60,971, according to the ABS.

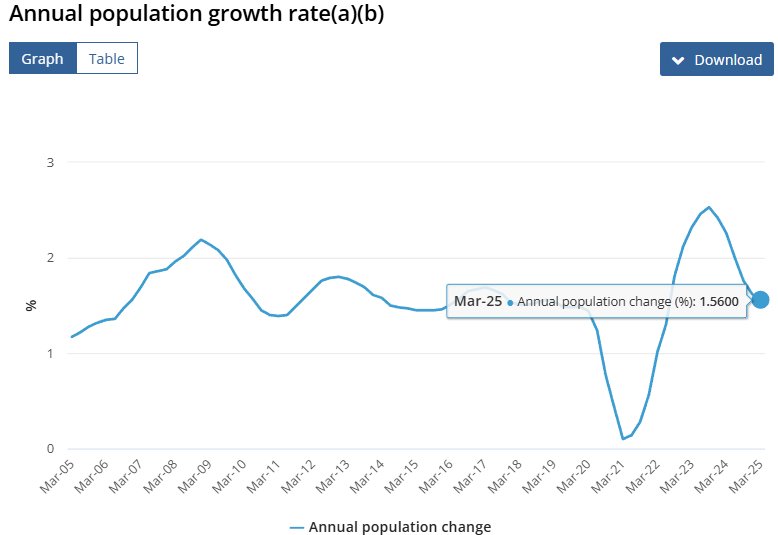

Population growth is slowing, but still rising, driven by immigration and the ongoing “Great Australian Dream” of home ownership. Domain also expects household incomes to lift in 2026, further supporting prices.

Final Thoughts

Market momentum is likely to continue, supported by earlier rate cuts and stronger demand from both first-home buyers and investors. Affordability and serviceability challenges may slow the upswing, and banks tightening certain lending channels will add caution, but the direction of prices remains clear. All major forecasters expect prices to rise over the next 12 months.

If you or someone you care about is considering the next move, whether entering the market or using equity to invest, now is perhaps the time to review that financial position. Understanding borrowing capacity, equity, and the options available today can help us act quickly when the right opportunity appears. For all our existing clients, we review loans every six months to keep things on track. If you’d like a fresh set of eyes on your loan now, just reply to this email, and John, Michael, or I, or one of our team members, will make sure you’re on the best terms possible.