Rates Drop, More Ahead + What’s Next for Property

Inflation is down. Prices may rise. Be ready.

Australia has recently experienced its second interest rate cut this year, which offers a welcome relief for current mortgage holders. This change also boosts the borrowing power for first-home buyers, those looking to upgrade, and investors. Historically, a rate cut like this tends to increase the demand for housing. Coupled with the current limited supply of properties, we might see upward pressure on prices, particularly in states where the market is more sensitive to interest rate changes. So, why are rates falling now? How many more cuts can we expect? And what does all this mean for your next property move?

📉 Why Are Rates Falling?

Good news, inflation is now under control. Both headline and core inflation have landed within the Reserve Bank of Australia (RBA’s) target range of 2–3 per cent (see below), and the domestic economy shows no real signs of reigniting price surges, even with a strong labour market (jobs market). This is why the RBA cut the official cash rate by .25 per cent, down to 3.85 per cent, as widely predicted by economists. Encouragingly, most lenders announced the news quickly, that they would pass the rate cut on to borrowers in full.

In the most recent media conference on the 20th of May, following this month’s rate cut announcement, the RBA governor Michelle Bullock signalled growing confidence about local inflation but raised caution about global risks. “Global economic and policy uncertainty has increased substantially… It’s been a complete rollercoaster.”

This uncertainty has weakened Australia’s growth outlook, and with inflation now under control, the RBA had room to act.

🔮 How Many More Rate Cuts Are Coming?

If inflation continues tracking in the 2–3 per cent band, we can expect more cuts ahead.

The current cash rate of 3.85 per cent is still considered contractionary, meaning it cools the economy. Most economists agree that a “neutral” rate sits between 3.35 and 3.6 per cent, suggesting 2–3 more cuts are likely this cycle. The RBA has forecasted that by December 2025, the cash rate will be cut to 3.4 per cent.

Here’s what major institutions are forecasting:

AMP: 3 cuts (Aug, Nov 2025 + Feb 2026)

CBA: 2 cuts in 2025

ANZ: 1 cut in Aug 2025, another in Feb 2026

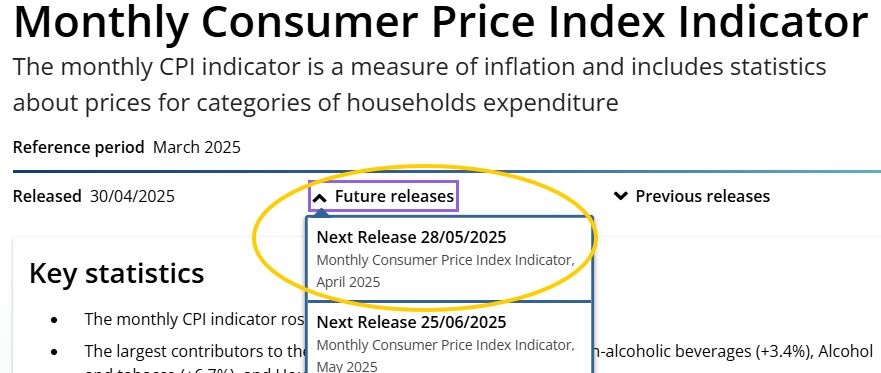

Keep an eye on the May 28 CPI release from the ABS — a key indicator of whether more cuts are locked in. This indicator will show how inflation is tracking and what households are spending.

🏘️ Will Property Prices Rise?

Lower rates usually drive demand and prices, but today’s landscape is complex. CoreLogic suggests that a 1 per cent drop in the cash rate could potentially lead to a 6.1 per cent rise in dwelling values. This suggestion, or notion, does make sense.

Today though, we’re in a period where affordability is stretched, lenders are still assessing our loans on the back of our current interest rate plus a 3 per cent buffer so while your actual repayment will be based off an interest rate of circa 5.65 per cent, the serviceability assessment that the banks are conducting, is being based at circa 8.65 per cent. So, while borrower sentiment improves, affordability remains tight. CoreLogic’s view: Don’t expect a boom — prices will rise, but not surge, until affordability improves.

Key states to watch? NSW and VIC, where household debt is higher and prices more sensitive to rate changes. Here’s a snapshot of Australian dwelling values, on 12 month rolling changes, and how they have performed since 2015, as a base for us to work with:

Final Thoughts

We’re in a rare window today. Inflation is stable. Rates are falling. The banks have passed on the rate cuts in full, but uncertainty from abroad, particularly from US trade moves, could still shift the course. For now, borrowing power is improving and price growth is likely but perhaps moderate. If you’re planning your next move whether buying, refinancing, or investing, these factors need to be considered. Economy continues to shift this year and staying informed is more important than ever. Whether you're reassessing your loan structure, planning a purchase, or just want to explore your options, we’re here to guide you every step of the way.

Start your personalised strategy today!

Kick things off by seeing what your borrowing capacity may look like here:

If you want to know more about different rates, terms, or bank specials currently available, please send a note to info@blackandwhitefinance.com.au, or click the start today button a little lower.

Reach out to us on

0448 890 186

or

Send us a quick online enquiry by clicking the start today button below.

Feedback

We’d love to hear what you think about our content or how we could improve to make your experience better. Please send a note to peter@blackandwhitefinance.com.au to let us know your thoughts.