Property prices surge, but value still exists

Inflation data due this week will determine whether the Reserve Bank of Australia (RBA) holds or cuts interest rates when it meets next month. Property demand is strong despite high rates and serviceability challenges, and supply continues to fall short of national targets. For buyers, the mix of strong demand, limited listings, and new incentives is keeping competition fierce. We’re seeing not only first-home buyers taking advantage of the expanded Home Guarantee Scheme (HGS), but also investors trying to get into the new higher price brackets. This month, we break down the key rate outlook, where property growth is strongest, and how policy changes are shaping the market as we head into 2026.

Any more rate cuts?

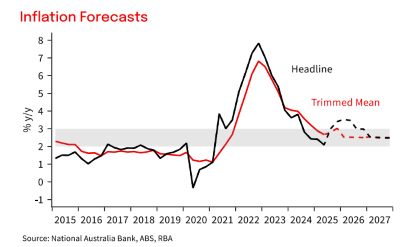

All eyes are on Wednesday’s inflation data from the Australian Bureau of Statistics (ABS).

NAB economists now expect just one more rate cut likely in May 2026, not this year.

Unemployment has risen slightly, which normally points to a weaker economy and supports a rate cut.

But inflation may hold the RBA back. The forecast for the September quarter is a 0.6–0.7 per cent rise. If CPI lands closer to 1 per cent, there’ll likely be no change. If it’s lower or on target, a November cut remains possible.

A cut is possible, but only if inflation cools. All eyes will be on the CPI release this Wednesday, 29 October.

What’s happening in property

The property market is running hot across the country.

Auction clearance rates: Sydney 70 per cent (57 per cent this time last year), Melbourne 67 per cent (61 per cent this time last year)

Agents and buyers’ advocates report even stronger results in select suburbs of Melbourne and Brisbane, where competition is fierce.

In short: high demand, low supply, and strong buyer confidence continue to fuel upward pressure on prices.

Where growth is strongest

Australian house prices are rising at their fastest pace in four years, with every capital city posting gains.

Sydney: Median price $1.75 million (+3.4 per cent in Q3) — fastest rise in two years.

Brisbane: Now the second-most expensive city, at $1.1 million median after 11 straight quarters of growth.

Melbourne: Re-accelerating, at $1.083 million — just $10k below its 2021 peak.

Adelaide: Surpassed $1 million earlier this year and still rising.

Perth: Just $19k off the million-dollar mark.

Darwin: Up 5.3 per cent for the quarter — the strongest growth of all capitals.

Domain’s chief economist expects national price momentum to continue accelerating in the short term, driven by rate cuts, stronger confidence, and low listings.

Brisbane, Perth, and Adelaide are leading on growth, while Sydney and Melbourne are picking up pace.

Note: These figures are from September. Early October activity looks even stronger based on client and agent feedback — we’ll be watching the data closely.

HGS changes and bank policies

The expanded Home Guarantee Scheme (HGS), effective 1 October, is driving more buyers into the market.

No income caps, unlimited places, and higher price limits mean more people can buy sooner.

First-home buyers can purchase with as little as 5 per cent deposit, without Lenders Mortgage Insurance (LMI).

Some banks are adjusting how they treat HECS debts, boosting borrowing capacity, especially for first home buyers to whom this typically applies to.

Investors are also targeting HGS-eligible areas to maximise returns.

The new HGS settings are adding fuel to an already-tight market.

Where to consider buying or investing

Cotality’s recent Q3 Housing Webinar, highlighted suburbs still under HGS price caps. Attached below is the report from this webinar.

If you’re a first-home buyer, it’s a useful guide to see how close you can get to the CBD within the new limits.

If you’re an investor, it’s a way to identify unit opportunities where affordability and demand overlap.

Click here and refer to pages 22–29 in the Cotality report to see where these suburbs are highlighted.

Drivers of property growth

Three RBA rate cuts this year have boosted confidence.

Population growth continues to climb.

Construction is lagging: the Housing Accord target was 240,000 new homes in year one (2024–29), but completions fell short by 60,971, according to the ABS.

Demand is surging, but supply isn’t keeping up, keeping prices on an upward path.

Final Thoughts

Property demand remains, and supply is tight. Interest rate cuts are possible, but not guaranteed, and as we know, are contingent on inflation and labour market signals. For both first-home buyers and investors: don’t wait passively. Use this period wisely and the information available to get clarity on borrowing power. Perhaps you could define your preferred areas, take advantage of schemes like the HGS, and move when the right opportunity emerges.

At Black & White Finance, we know that taking on more debt can feel daunting, especially for first home buyers, which is why we always weigh up the risks carefully to make sure these initiatives work in your best interests. For all our existing clients, we review loans every six months to keep things on track. If you’d like a fresh set of eyes on your loan now, just reply to this email, and John, Michael, or I, or one of our team members, will make sure you’re on the best terms possible.

P.S. We’re proud to share that Black & White Finance has surpassed 400 Google reviews. Thank you to every client who’s shared their experience. Your support drives our mission: creating life-long relationships through a simplified, tailored, and special lending experience.

If you know someone who’d benefit from the way we look after our clients, we’d be grateful if you passed on our details. Word of mouth is everything to us, and we don’t take your trust for granted.