Fixing Your Mortgage

Fixing Your Mortgage in Australia

The Complete Guide

Interest rates have been front and centre for Australian borrowers for years.

As rates move, many borrowers ask the same question:

Should I fix my home loan?

We explain how fixed-rate home loans work, the pros and cons, what rate locking means, and how to decide whether fixing is right for you.

What’s in our guide:

How Fixed-Rate Home Loans Work

Why Borrowers Choose to Fix Their Mortgage

The Downsides of Fixing Your Loan

What Is Rate Locking?

How much does it cost to Rate Lock?

Why should I Rate Lock?

How Long Should You Fix Your Mortgage For?

What Happens If I Break a Fixed Rate?

What is a Split Loan?

Fixed vs Variable: What’s the Difference?

Can You Make Extra Repayments on a Fixed Loan?

What Happens When a Fixed Rate Ends?

How Do You Choose the Right Lender for a Fixed Rate?

Getting the Right Advice

FAQ’s

How Fixed-Rate Home Loans Work

What is a fixed-rate home loan?

A fixed-rate home loan locks in your interest rate for a set term. Typically between 1 and 5 years.During that period:

Your interest rate stays the same

Your repayments usually stay the same

Market rate changes won’t affect you

At the end of the fixed term, your loan typically rolls onto your lender’s variable rate unless you review or refinance.

Why Borrowers Choose to Fix Their Mortgage

The Borrowers generally fix their rate for one reason: certainty.

The upside (pros)

Repayment stability

You will save money if rates rise while you’re locked in

Easier budgeting because you know what your repayment will be

Protection from rising interest rates, not just saving

Peace of mind during volatile periods

For households managing tight cash flow or planning major life events, certainty can matter more than chasing the lowest possible rate.

The Downsides of Fixing Your Loan

Fixed loans are designed for stability — not flexibility.

The trade-offs (cons)

Reduced or no offset account access

Potential break costs if you exit early, known as Early Termination Costs

Missing out on riding the downward slope if variable rates change direction

Less features

Less flexibility to be nimble with your property decisions because that property needs to stay at the lender you’re fixed with for that period

Limited ability to make extra repayments

Before fixing, it’s important to understand how these restrictions may affect you. Timing and understanding the market, your circumstances and what is in your best interests is vital.

TO UNDERSTAND YOUR OPTIONS, START TODAY

What Is Rate Locking?

How do I rate lock and guarantee a fixed rate?

A rate lock allows you to secure a fixed interest rate before settlement. This protects you if rates increase while your loan is being processed.

Rate locks are typically applied:

After formal approval

Before settlement

Not all lenders offer rate locks, and conditions vary.

How much does it cost to Rate Lock?

Most lenders charge:

A one-off fee, or

A percentage of the loan amount (often around 0.15%)

The fee is generally non-refundable.

Why should I Rate Lock?

You might consider a rate lock if:

Rates are rising

Settlement is weeks away

You want certainty around final repayments

It’s not always necessary — but it can reduce risk in uncertain markets.

How Long Should You Fix Your Mortgage For?

There’s no universal answer; it’s all about what is in your best interests.

As a guide:

1–2 years: Short-term certainty with flexibility to review sooner

3–5 years: Longer protection for borrowers prioritising stability

Rather than trying to predict the market, focus on how long certainty is valuable for your circumstances. Understand what your objectives are, what you’re planning for and make a decision that suits your risk appetite.

What Happens If I Break a Fixed Rate?

Exiting a fixed loan early, whether by refinancing, selling, or restructuring, may result in break costs.

Break costs depend on:

Remaining fixed term

Current market interest rates

Loan balance

They can range from minor to significant, so it’s important to check before making changes.

What is a Split Loan?

A split loan divides your mortgage into:

One portion fixed

One portion variable

This structure allows you to balance:

Stability (fixed portion)

Flexibility (variable portion with offset and extra repayments)

For some borrowers, it provides the best of both worlds.

Fixed vs Variable: What’s the Difference?

Variable Rate

Repayments can rise or fall

Greater flexibility

Easier refinancing

Full offset commonly available

Fixed Rate

Stable repayments

Limited Flexibility

Break costs apply

Often limited offset

Borrowers move between fixed and variable splits over time as their needs change.

They also change their splits over time to add more weight to one over the other.

There is no single, typical or conventional split for a Split Loan.

A borrower may choose to lock in 60% of there mortgage, and go with variable for the other 40%. Or vice versa, proceed with locking only 40% of there loan, with 60% left as variable.

Can You Make Extra Repayments on a Fixed Loan?

Usually yes, but within limits.

Most lenders cap extra repayments per year. Exceeding the cap may trigger break costs.

If reducing your loan quickly is a priority, this is an important consideration. Some lenders only allow you to pay an extra $10,000 per annum on the fixed rate portion.

What Happens When a Fixed Rate Ends?

When your fixed term expires, your loan typically rolls onto your lender’s standard variable rate. Unless your broker, or you as a borrower, can negotiate a competitive discount to apply to your rate from the moment it rolls across to variable.

This is a key review point. You can:

Refix

Move to variable

Refinance

Reviewing early can prevent paying a higher reversion rate.

How Do You Choose the Right Lender for a Fixed Rate?

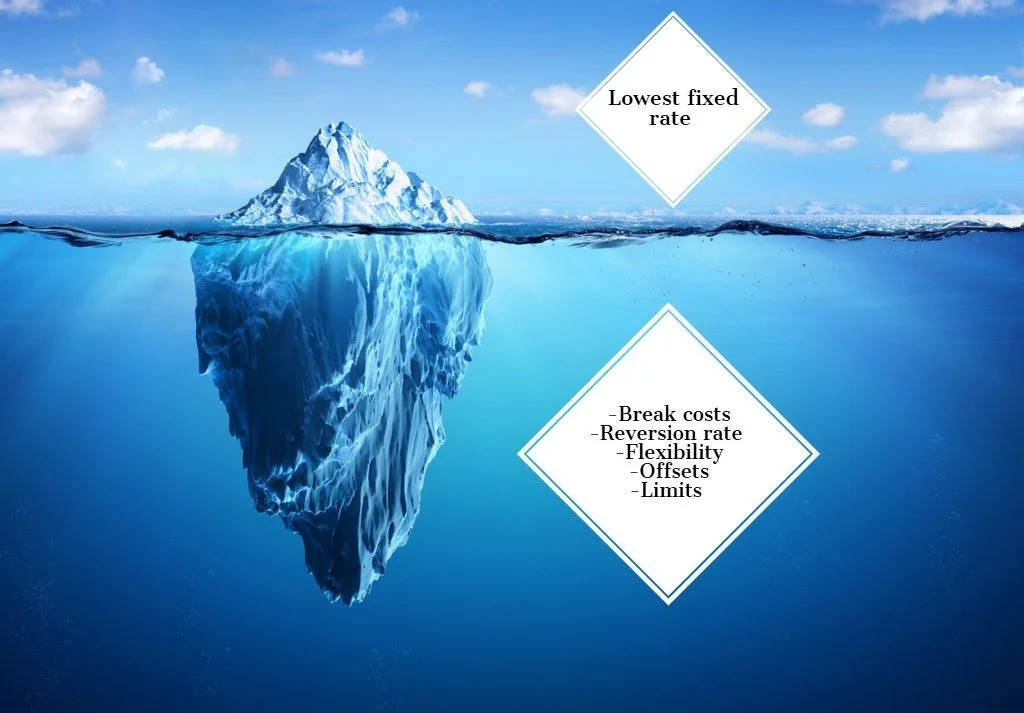

The lowest rate isn’t always the best option.

Important factors include:

Break cost calculation method

Extra repayment limits

Offset availability

Reversion rate after fixed term

Flexibility to restructure later

Choosing the right lender means aligning the loan structure with your long-term plans — not just today’s rate.

Getting the Right Advice

Fixing your mortgage isn’t about predicting interest rates. It’s about structuring your loan around your goals, cash flow, and appetite for certainty.

At Black & White Finance, we help borrowers compare lenders properly, understand trade-offs clearly, and structure loans that support long-term outcomes.

No grey areas. Just clear advice.

FAQ's

-

Fixing suits borrowers who value stable repayments and want protection from rate rises. It may not suit those who need flexibility or plan to sell or refinance soon.

-

Neither is universally better. Fixed offers certainty. Variable offers flexibility. The right choice depends on your situation and what is in your best interests.

-

Yes, but you may incur break costs if you refinance during the fixed term.

-

Some do, but many have limited offset functionality. This varies by lender.

-

Ideally 3–6 months before the fixed term ends. But if you’re with Black and White Finance, this happens automatically. We are proactive with all borrower's who are on fixed rate loans and approaching expiry. Getting in early makes the difference, before it rolls to a higher or rate that you’re not aware of.