RBA expected to hold steady for longer

If the data out of the US economy this week is anything to go by, our Reserve Bank of Australia (RBA) will likely hold the cash rate steady when they meet next week. Labour market shortages, and our population growth fuelling the rental crisis, are factors keeping consumer prices high. It’s not looking likely that we will see rate cuts mid-year as some experts or money markets predict. When you then add the construction of property and supply shortages, you have further inflationary pressures so the RBA will want to wait a little longer before considering to cut rates. If you have business debt or a home loan, dealing with the higher interest rates from the banks is going to last for a while. On the positive side, if you own property, these conditions may produce price growth for you this year, and we already see this in the data.

US and Aus economies

The Federal Reserve Board (Fed) won’t cut rates as early as predicted, following hotter-than-expected inflation in the US. On Thursday night, the US Producer Price Index (PPI), which measures the input costs for businesses, revealed a 0.6 per cent increase in February, double the 0.3 per cent of what economists expected. In addition, their headline and core Consumer Price Index (CPI) rose in February. Experts believe things are slowing down in the US, but not quickly enough for the Fed to cut rates.

AMP’s head economist Shane Oliver believes the US economy remains “on track for a start to rate cuts in June, although there is a high risk that it could be July.” Given the similarities between our economies, our own Australian RBA is likely to use the sticky inflation experience in the US as another reason for it to remain cautious for now at its upcoming meeting on Tuesday next week and reiterate that a further rate hike can’t be ruled out, according to Shane Oliver.

Another rate hike isn’t what borrowers want to hear.

Population growth and it’s challenges

In the year ending 30 June 2023, net overseas migration was 518,100 people, an increase of 314,500 since the previous year according to the Australian Bureau of Statistics (ABS). The population grew by an extraordinary amount, if you compare it to how it’s grown over the last 20 years and it’s putting a lot of pressure on consumer prices, on the labour market, on property and rents.

Rental crisis

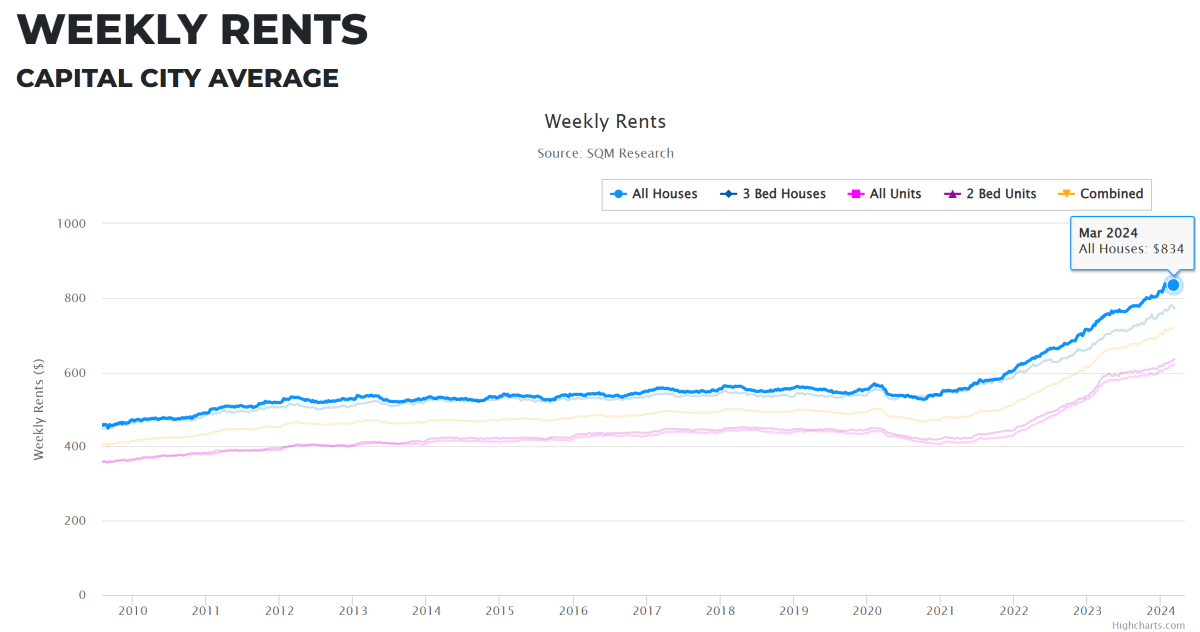

High rental prices and low vacancy rates, reflect the housing shortage that exists which is not looking likely to get much better any time soon and data from SQM Research demonstrates this. The impact of fiscal stimulus in the upcoming May Budget may provide initiatives to help alleviate this housing affordability issue in the economy but at the moment, it’s another element contributing to the inflation problem.

We need supply

To keep up with demand, we need building approvals and construction – we need supply.

Data from the ABS shows how it is taking longer to get units or houses approved and we know how expensive it is to build at the moment. Even if one build does make it through the pipeline, and it goes to market, data suggests it’s being met by demand.

Judo Bank leading economist, Warren Hogan believes our issue with building approvals and supply, is not likely to get any better in the next 18 months which is definitely not going to help renters.

Property holding up

As a property owner, the scene is set then with these contributing factors above, for property price growth again this year. Clearance rates are generally ticking up and data from Corelogic suggests there’s growth in the market, with Perth leading the charge.

Out-of-cycle rate hikes, rates to be high for longer

We’ve seen the banks face lower mortgage volumes, in comparison to their peaks of 2020 and 2022, which does suggest there are a lot of cashed up buyers or offshore investors present. With these lower volumes, the banks aren’t able to sell as many mortgages and so their profits come under pressure. Fierce competition out there from 2nd and 3rd-tier lenders is further putting pressure on these big bank margins. Consequently, we’ve seen the banks perform back-book pricing where they look to balance their profits by lowering discounts or slightly increasing rates for existing borrowers – something our Black & White Finance team is proactively managing for our existing customers.

As we head further into the year, we’re watching these banks that have been the cheapest closely, and if they’ve been the cheapest for a lengthy period, and on top of being the cheapest, are offering cash back too, they’re more likely to do this ‘back book pricing’. Or more at risk of doing this in 2024. At any point, these lenders could look to take some of this margin back by increasing rates.

Final thoughts

When we take into account the sentiment from economists, data from the US economy and recent indicators here in Australia, it’s likely that the RBA is expected to hold interest rates at 4.35 per cent next week. There will likely be commentary and reminders out of the RBA of how delicate the situation is and that we need to wait to really see consistent data showing that the inflation problem is under control and closer to it’s target range. Unfortunately, no real relief for households or businesses in the short term.

As we look further into the future, the upcoming tax cuts and the May budget may also influence the timing of rate adjustments. Out of cycle rate hikes by the lenders may do some of the work here for the RBA, and again, something we’re well on top of. We will continue to stay close to all of this and continue to ensure your lending solution is in your best interests to tackle this challenging period.

If you want to know more about the different rates, terms, or bank specials on offer at the moment or just have a general question, please send a note to peter@blackandwhitefinance.com.au or click the start today button a little lower. With the help of our amazing Black and White Finance team, we will be able to support you.

Reach out to us on

0448 890 186

or

Send us a quick online enquiry by clicking the START TODAY button