Are we ready for higher property prices?

Inflation is sticking around for a little longer but it has now peaked, which is good news. When the Reserve Bank of Australia (RBA) meets on Tuesday this week, we’re hopefully going to hear of another rate pause. With rate rises slowing or pausing, low housing supply, higher residential rents, and population growth, it all points to higher property prices. Will the NSW Labor Governments election promise for first homeowners further fuel property prices? And what does the RBA’s review look like for us going forward?

Inflation & rates have now peaked, or just about

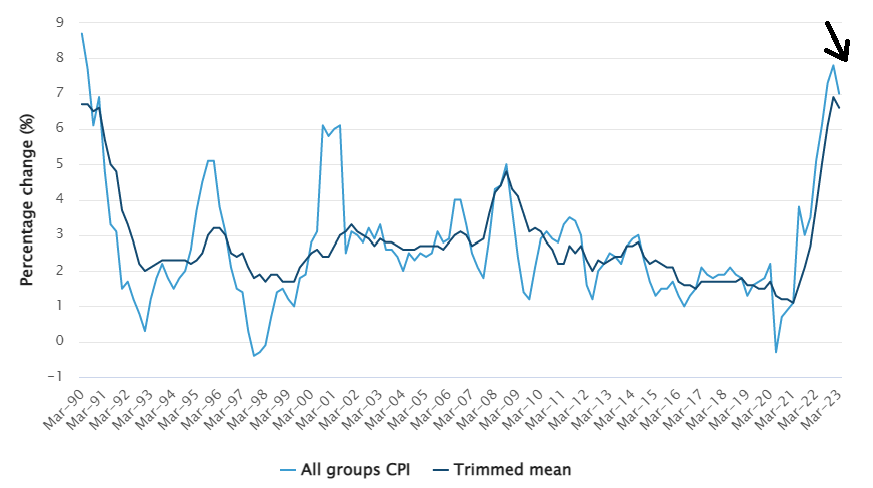

Off the back of last week’s Consumer Price Index (CPI) data, presented by the Australian Bureau of Statistics (ABS), it’s fair to say that Australia’s inflation levels have peaked. The data while still high, shows that inflation grew by 7 per cent in the March 2023 quarter, as opposed to 7.8 per cent as it did in the December quarter before.

Senior economists from most of the big banks suggest this means that our central bank is near the end of its rate hiking cycle but believe a further .25 per cent increase will come, just the timing of it is varied.

Some of the supply-driven inflation data, such as shipping costs as you can see in the graph below, have normalised, but food, which has come down a little, still remains high along with gas & electricity.

The good news for builders or renovators is that the rise in construction costs has slowed down.

While in some sectors of the economy, inflation is cooling, in others it’s not. High rental growth persists as per the graph below, in Sydney particularly, driven by increasing demand for housing from the higher than expected immigration numbers.

While CPI overall is heading in the right direction, it’s still not close enough to this 2-3 per cent range that the RBA needs to achieve each year, but there's signs it’s on the way down.

It's again a tight line for the RBA to be walking, leading into the next meeting. Do they conservatively hike rates by .25 per cent and officially close the lid on any inflationary pressures in case there’s a small spike in the data, or, is everything at the moment on track and there’s no need for further hikes? We at Black & White Finance believe or hope the RBA will hold on Tuesday.

The RBA review & will it make a difference?

Our future RBA is going to look different next year after the independent review recommended a significant change in the way it approaches and sets interest rates. While yes, a review was necessary, it’s unclear whether the recommendations will significantly improve the way we set interest rates – the cash rate. At a high level, the proposed changes include:

- RBA meetings would move to 8 meetings a year (from 11)

- 2-3 per cent inflation target to continue but have it based also around price stability and full employment

- RBA to hold press conferences after each announcement

- 6 external members, with expertise in macroeconomics, the financial system, labour markets and the supply side of economics - having the potential to override RBA recommendations

- 2 boards - a governance board to actually manage the RBA and a monetary policy board to determine monetary policy & effectively manage interest rates

- the removal of the power of the Treasurer to overrule proposals

Click here for the final report & full details of ‘An RBA fit for the Future’, which was presented to the Treasurer on 31 March 2023.

Hindsight always provides clarity for us yes. And of course, if the RBA could go back in time to retract that “rates won’t move until 2024” comment, they would. While economic times here are not by any means comfortable, when you compare the results our central bank has achieved in the Australian economy, in comparison to most central banks around the world we're by no means worse. After enduring the GFC, the pandemic and more, we’re in a much better economic position in comparison, which you can argue is somewhat attributable to the work of our RBA.

Higher property prices with NSW in focus

These 'RBA fit for the future' recommendations are supposed to be implemented by mid-2024 but for now, the attention is on what the RBA will do in May (this Tuesday coming). The sentiment amongst senior economists who suggest that rates have peaked seems to be reverberating through the property market.

Adding to the assumption that rates have peaked, is the fact that there are fewer new property builds being approved or commenced so there's a shortage. Economists believe that with low supply and population growth, the property market is growing slowly once again, with Sydney leading the rebound. Based on recent trends, NSW Planning is actually expecting the state to grow on average by over 85,000 people each year until 2041, see graph below.

CoreLogic’s Home Value index rose 0.6% in March, the first increase since rates started rising in early 2022. Auction clearance rates are up too, see below. These factors do suggest that there are green shoots developing in the property market.

NSW Labor Government and First Home Owner Impacts

Home price growth in NSW will be tested when the former Liberal government initiative to offer first home owners the option of paying land tax for stamp duty is brought to an end in July 2023. The NSW Labor government with its first home buyer election promise, made clear it was to remove the land tax for stamp duty option, replacing it with its own full waiver of stamp duty up to $800,000, and a reduction for homes valued up to $1,000,000. There’s no benefit for any first home buyer purchasing from $1,000,000-$1,500,000 anymore. See here the property price brackets and differences in stamp duty. Please reach out if you'd like this table in an excel version or provided separately if it cannot be seen properly on your end.

If you’re a first home buyer, searching in the sub $800,000 bracket, the Labor government initiatives here could provide significant savings as property prices continue to rise. This initiative will likely exacerbate the problem for those in this price bracket and push prices further up.

For those first home buyers who’ve already selected the property tax option, it’s likely that this arrangement will continue and it’s unlikely that already settled matters would be reversed.

When you combine the current bank first home owner initiatives with these new Labor Government first home owner initiatives, this sector of the economy will be super busy going into the end of 2023 – potentially propelling property prices further.

Final thoughts

We've still got fierce competition from the banks, the rapid return of immigration, constrained supply and low rental vacancies, along with fewer properties being built or approved, and government initiatives for first home buyers. All of this logically means when we combine these factors, that we are likely to see property prices go north. If the RBA holds again next week, it’s likely to support this notion even more. What is for certain though is that we do unfortunately all need to get used to this inflation sticking around for a little longer but at least the data is pointing in the right direction.

It’s important to ensure your lending solution is in your best interests to tackle this challenging period and that each loan application is with the lender who’s conditions meet your specific requirements. We've worked very hard to create long-lasting, fostered relationships with all the 30 plus lenders on our panel, to ensure all our borrowers here at Black & White Finance are on the best terms available. Our finance strategies now more so than ever, need to be smart and in our best interests, to tackle this inflationary economic landscape.

If you want to know more about the different rates, terms, or bank specials on offer at the moment or just have a general question, please send a note to peter@blackandwhitefinance.com.au or click the start today button a little lower. With the help of our amazing Mortgage Broker Sydney – Black and White Finance team, we will be able to support you.

Reach out to us on

0448 890 186

or

Send us a quick online enquiry by clicking the START TODAY button

Feedback

We’d love to hear what you think about our content or how we could improve to make your experience better. Please send a note to peter@blackandwhitefinance.com.au to let us know your thoughts.